Explain Economic exposure might be concern to trendsetter Plc

Question – 1

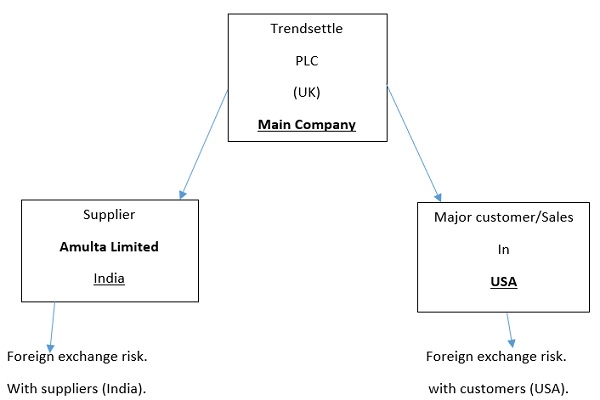

Trendsetter PLC in a UK company, which produces specific footwear and the company exports the footwear worldwide. But they have majority customer(sales) in the United States. There is a vender of Trendsetter and it is in India called Amulta Limited. Amulta Limited is supplier of skins. Which is major/basic raw material for manufacturing of shoes. Now we can understand the situation of this business. Model and for better understanding, this could be explained as follows-

1.a

Case and the solution

Identify and calculate the cost of the alternative strategies available for hedging this risk. Best strategy which would produce the best outcome for Trendsetter PLC. Actual spot rate in 6 months time is rupees 89.00 £.

In the given case, the exchange rate are indirect. These can be converted into direct quotes.

As follows-

- Spot Rate(Indirect Quote)

Rupees 90/

- Spot rate (direct quotes)

£ 0.011111111/ Rupees

Forward Rates ( 6 Months)

- Forward Rates (Indirect Quote)

Rupees 95/

- Spot rate (direct quotes)

£ 0.0105263157/ Rupees

Payoff In 3 Alternatives may be Found as follows.

- Forward Covers

- Trendsetter plc UK will buy a forward contract to cover the hedge & pay after 6 months.

Amount payable ( in Rupees) 100,000,000

Forward Rate = 1/95 = 0.0105263157

Amount Payable in 6 months time = 100,000,000*1/95

= 1,052,631.58 in 6 months time .

- Trendsetter plc UK can hedge their risk by money Market cover .

The borrowing into Indian currencies. Invest in Indian earn interest & pay at the end of 6 months.

Calculation for Money Market operation is as follows

- Amount payable in 6 months time to Indian suppliers = rupees 100,000,000

- PV @ 6.5% p.a. for 6 months 100,000,000 *1/1.065 = Rupees 93, 896, 713.615

- Spot rate purchase = Rupees 90/ ( indirect quote)

- Borrowing in

( 93,896,713.615 X 1/90) = 1,043,296.8179

Interest for 6 months UK @ 5 % p.a. = 52, 164.8408

Total payable in 6 month time = 1,095,461.6587

III. Currency Option

- Amount payable ( rupees) = rupees 100,000,000

- Total amount Payable in currency option ( option exercised price rupees 92/)

- Payment under option = 100,000,000 x 1/92 = 1,086,956.5217

- Premium payable = rupees 1,000,000 X1/90 = 11,111.1111

- Interest on option premium = 11,111.1111x5/100 = 555

Total payment in 6 months time = 1,098,623.1878

Statement of cost of alternative strategies is as follows for Trendsetter plc UK.

|

Particulars |

Forward cover |

Money Market Cover |

Currencies Option Cover |

|

Payment when hedging is not done |

100,000,000X1/89 1,123,595.5056 |

100,000,000X1/89 1,123,595.5056 |

100,000,000X1/89 1,123,595.5056 |

|

Payment as per different hedging alternative |

1,052,631.58 |

1,095461.6587 |

1,098623.188 |

|

Difference in alternative |

+70,963.9256 |

+28,133.8469 |

+24,972.3176 |

By analysing all the 3 alternatives for Trendsetter plc UK & after calculation of cost of the alternative strategies avilabe for hedging the risk we have found that the first alternative is best

& by using the first alternative Trendsetter PLC UK will save of +70,963.9256.

This is the best alternative I suggest.

Question 1. B.

Explain Economic (operating ) exposure might be concern to trendsetter Plc even when they do not have any FDI( Foreign Direct Investments).

Answer :

As we have seen in the solution of part (a) question that Trendsetter Plc. U.K. is importing skin from an Indian suppliers called Amulta Limited and having Large customer base in United States of America . As we know that in the present world of globalization we are talking about Global Business . As per the concept of international Economics it is said that all countries are having different advantage according to their geographical location, their work force capability, their technology, their specialization in different field. According to these principle no country can be self sufficient in the all fields. Hence they have to depended on the International Business . It is also a Management philosophy that we should concentrate on our specialization. Due to this situation every country has to depended on other country and due to these reason there are immense need for international business.

Now we know that foreign Exchange Market is very much vulnerable compare to stock market , commodity market or any other market. All types of market are price sensitive but Foreign Exchange Market is much vulnerable. And it depend on the so many factor.

For understanding the economic operating exposure concern to trendsetter Plc. UK, we need to understand what is Economic( Operating ) Exposure.

Economic Exposure is a type of foreign exchange exposure caused by the effect of unexpected Currency fluctuations on a company’s future cash flows, foreign investments, and earnings. Economic exposure, also known as operating exposure, can have substantial impact on a company’s market value since it has far reaching effects and is long term in nature. Companies can hedge against unexpected currency fluctuations by investing in foreign exchange(FX) trading.

The degree of economic exposure is directly proportional to currency volatility. Economic exposure increases as foreign exchange volatility increases and decreases as it falls. Economic exposure is obviously greater for multinational companies that have numerous suppliers and customer overseas and huge number of transactions involving foreign currencies. However, increasing globalization has made economic exposure a source of greater risk for all companies and consumers. Economic exposure can arise for any company regardless of its size and even if it only operates in domestic markets.

Now with all the above discussion you could have understand that how in international environment globalization is must for all most all the countries as well as for all the companies. And this increases the operating exposure for any company who is dealing in imports and exports. In this case the same thing is happening with the Trendsetter Plc. U.K that this company is sourcing is major raw materials from Amulta Limited India and having major customer in US. Had this company been sourcing all the raw materials from UK and had they been having customer only in UK in this situation no Foreign currencies exposure risk would have been there. But due to import and export and vulnerability of foreign currencies it is really a concern for the Trendsetter Plc UK. Even they have not invested in FDI.

C). Describe the additional operating exposures Trendsetter Plc would be exposed to if they were to engage in FDI and describe the strategies the company might undertake to reduce its level of economic exposure.

Answer: Following are the different type of additional operating exposures.

- Transaction Exposure : Usually there is time gap between sale of goods and services and the receipt and payment. During this period, the exchange rate may change and there may arise a risk due to exchange rates. This risk is known as transaction exposure. A transaction exposure occurs when a value of a future transaction, though known with certainty, is denominated in some currency other than the domestic currency. In such case the monetary value is fixed in terms of foreign currency at the time of agreement which is completed at a later date. All fixed money value transactions such as receivables, payable, fixed price sale and purchase contracts, etc. are subject to transaction exposure. The transaction exposure looks at the effects of fluctuations in exchange rates on the transactions that have already been entered into and have been denominated in foreign currency. It may be noted that if the payment is denominated in payment is in the domestic currency of the importer, then the risk of transaction exposure goes with the exporter. So the receipts and payment denominated in foreign currency have payment( denominated in foreign currency) are more than the payment(denominated in foreign currency), the decrease in value of foreign currency will cause exchange loss and appreciation in the value of the foreign currency will bring exchange gains. However, if receipts are lower than payment, decrease in value of foreign currency will create gains and appreciation will create losses.

- Economic exposure: when an exchange rate changes, one currency depreciates and the importers of that country would pay more for the current transactions. This is known as the transaction exposure. The other effect of the change in exchange rate would be that good will be dearer and customers have to pay more for the same product. This would affect future cash flow by affecting the sales and competitiveness.

In case the currency of the exporter’s currency depreciates, the exporter stands to gain in terms of current transactions. THE GOODS/ SERVICES WILL BECOME CHEAPER RELATIVE TO competing countries and there exists a possibility of making increased sales and profits. This is know as the economic exposure of the firm.

The economic value of an asset or collection of assets, is the present value of the future cash flows that the assets would generate. For a firm the economic value is the present value of the future cash flows. The economic exposure refers to the probability that the change in foreign exchange rate will affect the value of the firm. Since the intrinsic value of the firm is equal to the sum of the present values of future cash flows discounted at appropriate rate of return, the risk contained in economic exposure requires a determination of the effect of changes in exchange rates on each of the expected future cash flows.

The value of the foreign asset or foreign subsidiary is affected not only by the business risk but also by the exchange rate risks. The value of a foreign operation at any time depends upon the future cash flows, expected exchange rate and the appropriate discount rate to be applied to find out the present values.

Economic exposure is a broader and more subjective concept than the transactions and translation exposure because it involves the potential effects of change in exchange rates on all aspects of operation of the firm. So, the measurement of economic exposure requires that a detailed analysis of the effects of exchange rate changes should be made.

Strategies for managing exposure risk.

- Forward Market Hedge.

- Option Market hedge

- Future Market Hedge

- Money Market hedge

- Other Methods of hedging a transaction exposure like

Hedging through currency invoicing, netting the payment/receipt position/exposure netting.

- Currency Swaps

- Operational Strategies

- Diversification Production Facilities and market for products

- Sourcing Flexibility

- Diversifying Financing

- Matching Currency Flows

- Currency Risk- Sharing Agreements

- Explain why translation exposure might be concern to multinational organizations and briefly describe how a multinational organization might reduce its exposure to translation risk.

Solution.

- Translation Exposure : Firms have translation exposure when they consolidate their foreign operations( foreign branch subsidiary) into the local financial statements. For such consolidation, the foreign currency items are converted into local currency. So, the translation exposure occurs when the firm’s foreign balances are expressed in terms of the domestic currency. The change in exchange rate can alter the values of assets, liabilities, exposures and revenues of foreign operations.

The translation exposure is also called Accounting Exposure and deals with the probability that the firm may suffer a decrease in assets value due to devaluation of a foreign currency even if no foreign exchange transaction has occurred during the year. This exposure need to be measured so that the financial statements, i.e the balance sheet and income statement reflect the change in value of assets and liabilities. It may be noted that the assets and liabilities are considered exposed to foreign exchange risk if their values are to be translated into parent company currency using the exchange rate effective on the balance sheet date. Other assets and liabilities and the capital that are translated at historical exchange rates. i.e. the rates in effect when these items were first recognized in the balance sheet, are not considered to be exposed.

Method of hedging Translation Exposure

- Balance Sheet Hedge : Translation exposure is not purely specific: rather it is only currency specific. A mismatch of net assets and net liabilities creates it. A balance sheet hedge will eliminate this mismatch.

- Derivatives hedge :

Solution no. 2.

- Advantage and Disadvantage of the following strategies.

- Trendsetter plc UK is considering whether to engage in a joint venture with Amulta Limited.

Advantage of Joint Venture:

- In a situation of forming joint venture we need to understand the structure of business model of joint venture. In fact this model of business is being done by two or more than two parties for completion of some special time or project bound business. Like construction of a dam, bridge, building or for drilling for a petroleum project etc. but in this business Trendsetter plc would be needing the leather as raw materials on regular basis. So for regular business joint venture type is not suitable and you can do the joint venture business agreement for longer periods. As we are able to see from the situation given in question there are going to be huge demand for leather raw materials and in joint venture business model Trendsetter plc will not have any controlling interest on Amulta limited and if the other competitors offers better terms and condition there is every possibility that Amulta Limited may find a new ventures or a new buyer .

Ya the advantage of the model is that the exposure od Trendsetter plc will be less and in any situation of eventuality they can walk away with this venture with lessor losses.

- ii) Advantage and disadvantage of taking over the Amulta Limited .

In this business model Trendsetter plc will have an absolute advantage and with huge investment it can buy more than fifty percent share of Amulta Limited and get the controlling interest . if the holding company buy 100 percent in the Amulta limited than all types of risk of leather supply is reduced. All type of sourcing risk has been avoided and Trendsetter Plc will not face any problem for getting the supply of raw materials . there will be no threat in the future from the competitors even in the huge demand for the raw materials. The Disadvantage is that trendsetter plc will have to invest huge amount for getting controlling interest and would be facing translation exposure risk also. After investing this huge amount Trendsetter plc would be facing so many different kind of risk like political risk, economic risk etc.

iii). Third Alternative : Trendsetter plc is considering setting up a new company to prepare leather for exporting themselves .

Trendsetter Plc UK want to setting up a new company to prepare leather for exporting themselves.

But the point is why when we are having second option to acquire the Amulta Limited than why Trendsetter plc UK want to invest in the new company. It is only possible when Amulta Limited has refused to sell their company as well as refuse to sell their product to original company. If they are ready to sell than no need to go into investing into a new company. But there are few situation when Trendsetter plc Uk will invest in a new company and start a greenfield project .

- When Amulta Limited has refused to sell their company.

- When Amulta Limited refused to sell leather to Trendsetter Plc.

- By investing into a new green field project they can start with a new technology of production.

- By Investing into a new green field project they can get tax concession which may not be available to Indian old company.

These are the reason Trendsetter plc uk will invest in a new company but investing in a new company will have lot of disadvantage also . as they are having expertise in the manufacturing of shoes they might not be having experience in manufacturing leather. Amulta limited company are old company and having lot of experience and they are supplying to world class company hence the quality of leather product from new company may not be as good as Amulta Limited .

- b) Explain and provide examples of the various motives for direct foreign investment.

Solution:

For understanding of Foreign Direct Investment we need to understand the meaning of FDI.

A foreign direct investment(FDI) is an investment made by a firm or individual in one country into business interests located in another country. Generally, FDI takes place when an investor establishes foreign business operations or acquires foreign business assets in a foreign company. However, FDIs are distinguished from portfolio investments in which an investor from portfolio investments in which an investor merely purchases equities of foreign – based companies.

Important points and motive of FDI.

- Foreign Direct Investments (FDI) are investments made by one company into another located in another country.

- FDIs are actively utilized in open markets rather than closed markets for investors.

- Horizontal, vertical and conglomerate are types of FDI’s. Horizontal is establishing the same type of business in another country, while vertical is related but different, and conglomerate is an unrelated business venture.

- Now we have to understand the environment of business model of multinational organization. You take any example like Apple, Honda motors, Hyundai motors, sony, LG, Samsung and so many multinational company. They are having dedicated research and development facility and they develop a product of international portfolio. Once their product is develop they focus for selling the product worldwide. So what they do they do foreign direct investments(FDI) in most of the country, start their own plant and manufacturing their product and capturing the business of that country.

- There are so many motive of FDI. Firstly they want to capture the worldwide market, as they are having superior product they beat the competitions. They want to reduce the transportation cost for import and export of their finished product. They take the advantage of govt. policy for setting up new plant and they get lot of tax benefits also. They are benefitting in the transfer pricing also. Through transfer pricing they avoid the tax ion the country where higher slab rate are there and they save lot of tax in the country where low rate of taxation are there.

Example of FDI:

There are millions of FDI examples we are having in the across the globe.

Major investment attracted in last twenty year is by china, and now a days India is also a destination for FDI. But in the present scenario of global village business a lot of companies are investing into cross section of the world. Even some time Indian company are investing in the us company.

Few examples is as follows:

In 2017, for example US based Apple announced a $ 507.1 million investment to boost its research and development work in china, Apple’s third larhest market behind the Americans and Europe.

China’s economy has been fueled by an influx of FDI targeting the nation’s high tech manufacturing and services, which according to china Ministry of commerce, grew 11.1% and 20.4% year over year, respectively, in the first year of 2017. Meanwhile 100% FDI regulations in India now allows 100% FDI in single brand retails without government approval. Walmart invested $ 16 billion as FDI and purchased 77% in flipkart.